Last year I wrote this same post and the story was pretty similar, market was under heavy selling and consolidating.

But by the end of May market broke out, and as we had our watchlist of growth stocks ready we could ride a nice 2 month bull run.

Last year run:

Some gurus this year as every year are repeating this quote about selling everything and stay out of the market. I say, stay out BUT with your watchlist ready and set to go, because this market has prooved to be resilient again and again. So be ready because just as for today $SPY is poised to break into new grounds.

Watch the similary with this year consolidation:

Lesson learn, stay in cash while consolidating, or with very small exposition, but keep your watchlist up to date because this market is getting ready for a new bull run, it may or may not happen, but we need to be ready.

THE MIGHTY WOLF

Translate Page

Thursday, May 14, 2015

Monday, May 11, 2015

Hot Trending Industry Group: Computer Software-Gaming

Whenever the market starts to shakeout several leaders and indeces start to jump around all over the place without a clear trend, we have to take a look within industry groups to be aware of any shift in trends of industry groups.

Just giving a heads up, the computer software gaming group of stocks are currently trending higher and steadily moving up the ladder.

The relative position of the group was:

This week: #7

Last week: #14

3 weeks ago: #29

6 weeks ago: #62

This group has continuosly trending higher as the market keep shaking off the laggards and showing new leaders.

Some names on this group: $EA $ZNGA $SOHU $ATVI

Per my rules I rather trade $EA because of the market capitalization and liquidity.

Another great performance indicator is that for past 8 quarters in a row $EA has being increasing their fund ownership, that is a rare high number. And if the big boys want this stock I want it too.

The stock reacted very well to past week earnings report, breaking out on almost 3x above average volume.

Definitely at least a stock/industry group to keep on your watchlist.

Friday, March 20, 2015

March Week 3 Review

Just adding one stock to our weekly watchlist, $HELE broke out through 80, not with huge volume, we'll see if today shapes a FTD with higher volume.

Other great looking stocks $BJRI $ORLY $REGN.

Several growth stocks are still extended since january uptrend, not a lot a of opportunities these days, but we like to keep our watchlist updated.

Other great looking stocks $BJRI $ORLY $REGN.

Several growth stocks are still extended since january uptrend, not a lot a of opportunities these days, but we like to keep our watchlist updated.

Friday, March 13, 2015

March Week 2 Review

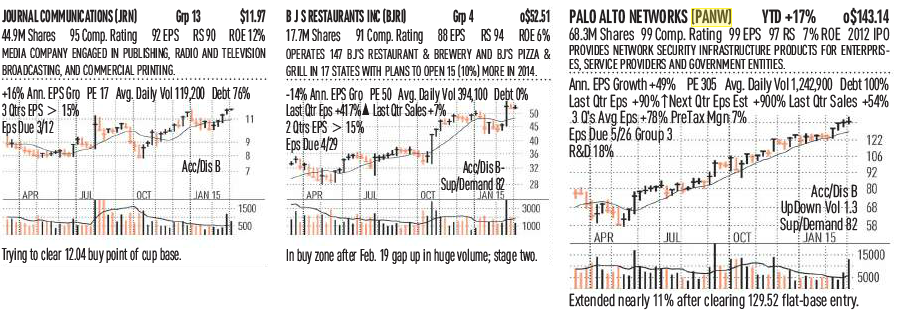

Doing a recap on this week, $JRN reported earnings that toped market expectations, so we bought back our shares because is still looking good for higher prices, not a large position because we are not fans of cheap stocks.

$MYL broke out on 3x above avg volume, we are adding on todays pullback, but still not a large position.

$BJRI has nothing wrong, is working as expected, we stopped out, per our rules, but if you still have your shares the action looks pretty normal. Probably will buy them back if the markets rebounds.

Market is in a correcting stage as we expected on previous weeks, small caps $IWM bounced strong from 50-day as well as $QQQ but $SPY is still struggling with 205.95 level, if by the EOD $SPY closes above this area next week could be a positive week and we would add on our current positions.

Click to enlarge the graphics. Have a great weekend.

$MYL broke out on 3x above avg volume, we are adding on todays pullback, but still not a large position.

$BJRI has nothing wrong, is working as expected, we stopped out, per our rules, but if you still have your shares the action looks pretty normal. Probably will buy them back if the markets rebounds.

Market is in a correcting stage as we expected on previous weeks, small caps $IWM bounced strong from 50-day as well as $QQQ but $SPY is still struggling with 205.95 level, if by the EOD $SPY closes above this area next week could be a positive week and we would add on our current positions.

Click to enlarge the graphics. Have a great weekend.

Friday, March 6, 2015

March Week 1 Review

Find below this 3 guns, despite main indices are pulling back, most leaders are holding up well, I took some profits last week but know I'm adding again on this 3.

Trade wisely wolfies.

Trade wisely wolfies.

Subscribe to:

Comments (Atom)